Our income tax services provide comprehensive solutions to help individuals and businesses navigate the complexities of tax laws. From tax planning and preparation to compliance and optimization, we ensure that you minimize liabilities while maximizing opportunities for savings. Our experienced team stays updated on the latest regulations to offer strategic advice and deliver accurate, timely filings that meet all requirements.

Services

Expert Income Tax Services for Individuals and Businesses

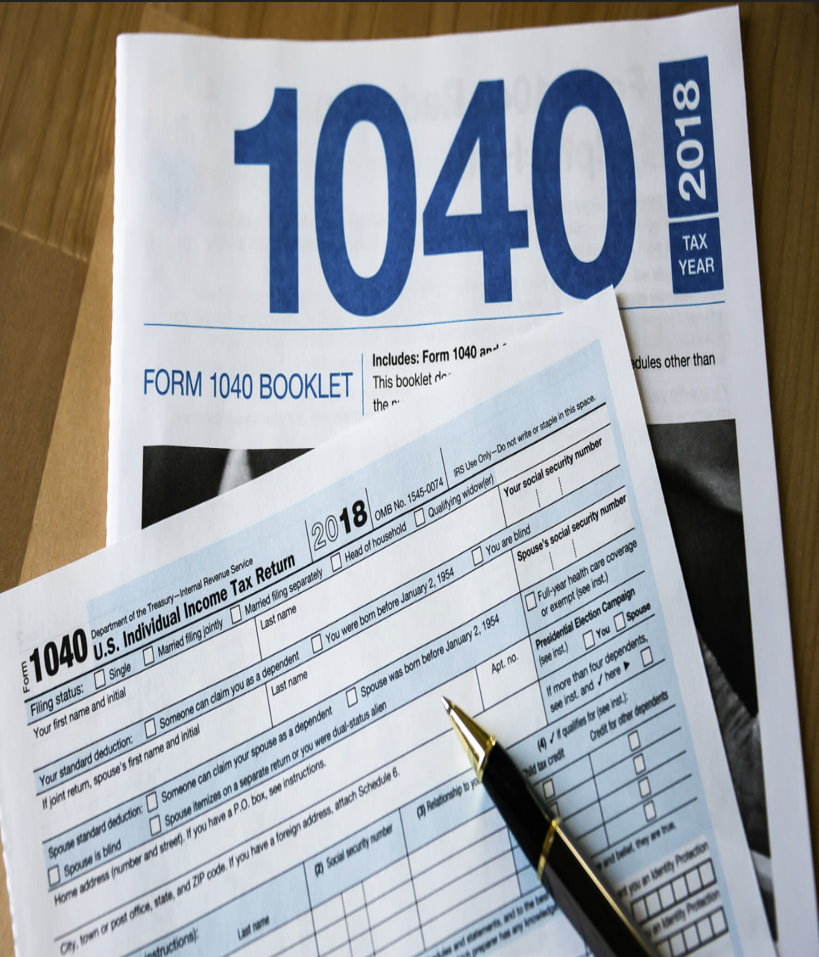

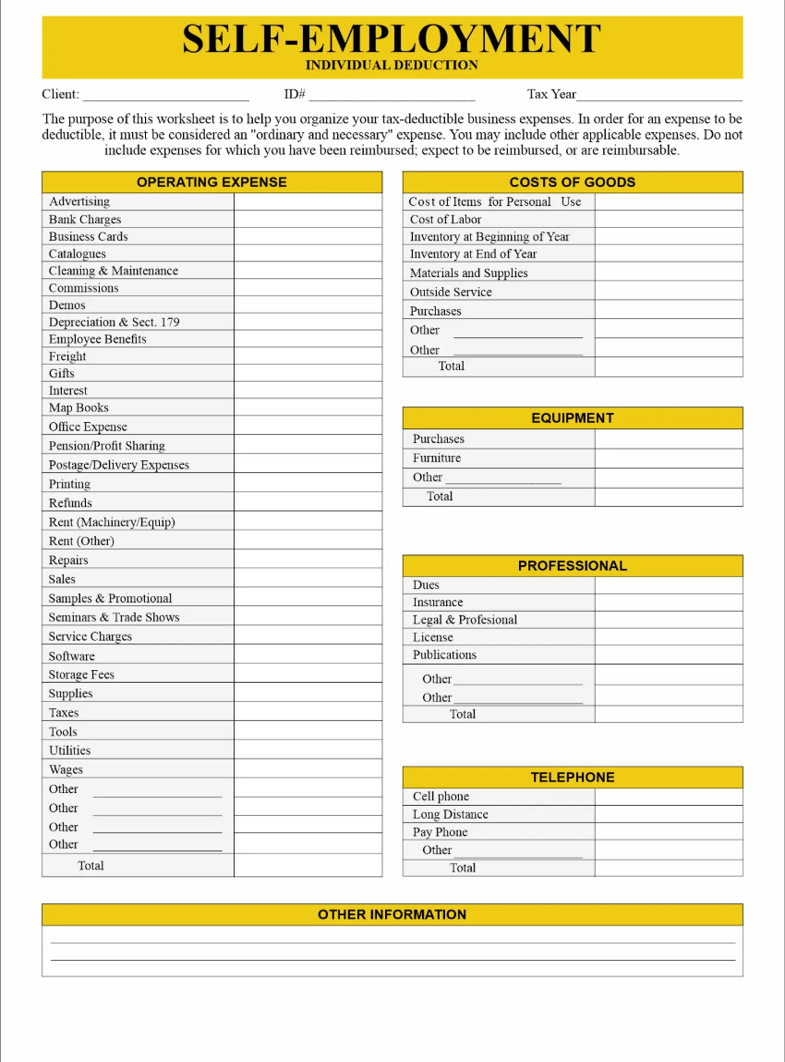

U.S. Corporate or Personal Income Taxes

- Form 1040’s, 1040NRs, 1120s for C corps/llc/S corps

- Cross Border U.S. Citizens residing in Canada

Canadian Corporate or Personal Income Taxes

- T2s, T1’s, GST, 85 Rollovers

- Cross Border CND Citizens working in the U.S.

- Foreign Tax credits, T2209

- Tax planning and dealing with the IRS and CRA audit letters

- Incorporation

- Assistance with Income taxes and deferred taxes for Financial Reporting, U.S. GAAP ASC 740 and IFRS IAS 12

INCOME TAX